You have read many blogs and articles, here and elsewhere, that give you steps 1, 2, 3, etc., on how to save money, pay your tax bill, incorporate your business. They all have tried and true advice which you may have used in your business and personal finances.

Blah, blah, blah…

We know that they can all be boring after awhile. So, to break up the boredom of your typical “How-to” finance article, we are going to offer you a satirical, tongue-in-cheek Guide to Messing Up Your 2018 Income Tax Preparation:

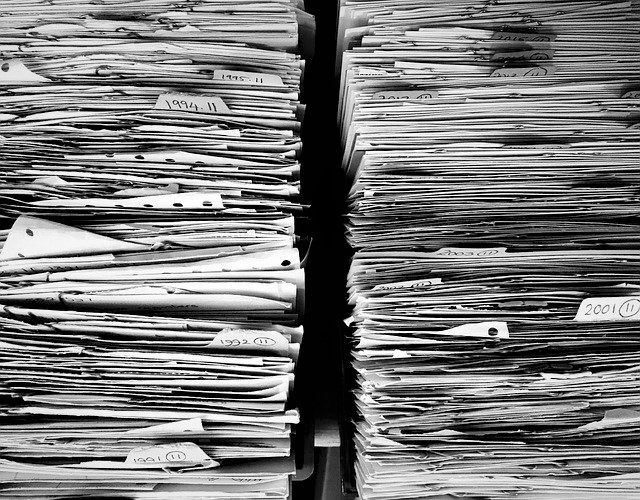

- Don’t organize any of your documents: Be sure to pile them in a shoebox, willy nilly, with absolutely no organization whatsoever. Make sure they are ripped, have nothing noted on the receipts and are the wrong year.

- Forget to include statements: Credit cards, payroll, expenses. They are so much trouble to print.

- Travel expenses mileage: Don’t use mileage records during the taxable year, just make up a mileage number! It’s just fuel after all.

- Write all your contractors expenses on a piece of paper: Instead of submitting contractor expense receipts, just use a notepad with amounts on it. No dates or receipts needed. Too much trouble!

- Don’t ask for any receipts for donations to non-profit/charitable organizations: Donations are just a nice thing we all do. Sure, you may owe less to the IRS if you accepted them or kept them, but you did it for a good cause. Who needs to brag about it, after all!?

- Turn in all your tax documents to your accountant on April 14: Everyone is so persistent in getting the tax filing postmarked by April 15, Tax Day. That is so arbitrary! Besides, your accountant is working 24 hours a day anyway, from January 1 to April 15. They won’t mind one more client bringing their files in at the last minute. They should be happy to be doing your taxes, anyway. It’s job security, right? Be sure your shoe boxes have your last name and phone number on them.

- Argue with Your Accountant over their fee: Your accountant is charging that much per hour to add up numbers? Good grief that is highway robbery. All they need is a calculator and number two pencil and they got it made. Make sure they know you can do it better and be late in paying the bill.

- Forget to pay the IRS bill: They had the temerity to charge you even more after you have paid them all year from your paychecks!! You’ll show them. Yeah, pay late. That will scare them. Mean old government agency.

Now, do you feel better? Actually, no. This was after all, satirical, tongue-in-cheek blog not meant to be taken seriously. You should do EVERYTHING OPPOSITE to what you read above.

After all, there are serious legal complications if you fail to comply with the tax laws. The IRS has an ITA (Interactive Tax Assistant) online which can help you with some legal questions you may have.

In fact, the best tax advice, besides doing exactly opposite of 1-8 above, is to contact our A.K. Burton, PC offices in Bethesda, Maryland. Our experienced and licensed tax lawyers and accountants can answer all your questions and also assist you with your income tax filing preparation. We serve clients in the Washington, D.C., Bethesda, Maryland and Northern Virginia region.